So what is the largest bankruptcy case in United States History?

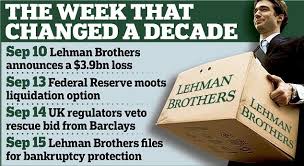

Lehman Brothers filed Chapter 11 bankruptcy in September 2008. The value at bankruptcy: $691 billion in assets. Lehman was eventually liquidated after its financial crisis accelerated and the government make the decision not to bail our the huge investment bank.

The U.S. government did not announce any plans to assist with any financial crisis that developed at Lehman. On September 15, 2008, Lehman Brothers filed for Chapter 11 bankruptcy protection. The claim had been called a “most momentous bankruptcy hearing.”

Five years later, the Lehman Brothers bankruptcy is still a topic of conversation concerning the financial crisis of 2008, hoping in retrospect the cause of the crisis could be identified in order to save the economy from a recession.